USInstallmentLoans Review: Easy Access To Online Installment Loans With Bad Credit

If you happen to have a history of bad credit, it can often be a frustrating experience to try and secure an installment loan from a bank or credit union. And even if your credit score is good, you may need the cash urgently to deal with an emergency, but most traditional lenders often take days just to process a loan request.

Luckily, some companies make it easy to take out installment loans online, such as USInstallmentLoans, that can be processed within the same day, even if you have a poor credit history. However, with so many lending companies claiming to offer the best loans online, it can be difficult and exhausting to find a reputable and trustworthy lender.

So, we researched one of the best online credit services in the current market, USInstallmentLoans, as we looked for a way to simplify the search process for borrowers online.

What Can USInstallmentLoans Be Used For?

The first thing to keep in mind is that USInstallmentLoans is not a direct lender. They are an online credit broker that provides borrowers of all credit types with a platform to connect with potential lenders and compare loan offers to get the lowest prices.

Since they have ties to several online lenders, this also allows borrowers to access a wide variety of loan products, such as payday loans, bad credit loans, installment loans, and more. This means that no matter what your financial situation or crisis may be, as long as you navigate to this page, you can find a line of credit that is well-suited to you.

Whether it be a loan for debt settlement, auto repairs, or healthcare needs, USInstallmentLoans can help you find a suitable lender. In most cases, borrowers can obtain modest, unsecured loans that range from $100 to $35,000 with terms ranging from 3 to 36 months.

The site also offers one of the most user-friendly interfaces, which makes it easy to get a loan offer within minutes. All you need to do is submit a few details via the online pre-approval form, and USInstallmentLoans will share the information with the lenders in its network.

The lenders that approve your loan request will then send you their offers, which will typically vary depending on your credit score and capacity to pay.

How to Get Started With USInstallmentLoans?

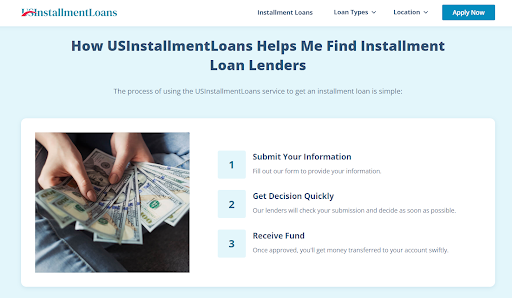

One of the main benefits of using USInstallmentLoans to find an installment loan provider is that the company does not charge borrowers anything to use their platform. It is completely free to use, and the loan application process is quite simple.

The first step that you need to take is to head to the USInstallmentLoans homepage. From there, you will need to select your desired loan amount and fill out the loan request form. This will require you to share some basic information, like your contact details, social security number, bank details, credit score details, etc.

Once you have submitted the form, USInstallmentLoans will share your information with their partner lenders. If they approve your request, you will receive multiple loan offers from different lenders, each with its own rates, fees, and terms.

You will be able to review and compare the loan offers to find the best deal that fits your budget and requirements. Bear in mind that there is no obligation for you to accept an offer and that all loan rates and fees are determined solely by the lender.

As such, if you have any questions regarding a loan offer, you will need to contact the lender directly. If you decide to accept one, you can e-sign an agreement, at which point the lender will start to process your funds.

In most cases, you can expect the funds to hit your checking account in as little as 24 hours, depending on how fast your bank handles deposit transfers. Also, don’t forget that most online lenders will typically charge a high late fee for any payments you fail to make on time.

Why We Appreciate USInstallmentLoans

#1. 100% Free To Use

One of the most commendable aspects of using USInstallmentLoans is that, unlike most lending services, this one is completely free to use. they do not charge borrowers any fees to use their platform and since there is no sign-up required, you don’t need to pay for any membership either.

There are also no hidden charges or taxes, as the only fees that you will need to pay will remain solely between you and your chosen lender and are usually included in the loan agreement’s fine print.

#2. Reliable & Trustworthy Lenders

While USInstallmentLoans does not have any direct influence over the lenders and their loans, the company does make sure to vet every single loan provider in its network.

As such, any lender you connect with via their platform will be a legitimate and licensed loan provider that provides fair and reasonable loan rates and terms. This minimizes any potential risk of fraudulent or predatory lending practices that could potentially put you in bad debt.

#3. Responsive Customer Service

USInstallmentLoans can be relied upon to provide excellent support throughout the entire loan process, as their responsiveness to any inquiries or complaints is extremely quick and efficient. They also provide full disclosure and transparency, so if there’s anything that you are struggling to understand, they will be happy to clarify, making it an ideal choice for first-time borrowers.

The only limitation is that you will only be able to ask about your loan application, as once you sign your loan agreement, they will only be able to refer you back to the lender if you have a problem that you need help with.

#4. Full Lending Transparency

Another great aspect of the service is USInstallmentLoans’ dedication to ensuring that borrowers are provided with clear transparency into any loans that are offered. Most lending institutions do not publish their rates so openly, but with USInstallmentLoans, you can instantly review and compare offers to secure the best deal possible.

They will also make sure that any charges or fees that you will incur are made clear and apparent for you to see before you sign any loan agreements. This helps to ensure that you don’t find yourself stuck with considerably high loan payments that you can’t afford.

Does Using USInstallmentLoans Affect Your Credit Score?

USInstallmentLoans does not make any actual credit decisions, and their lenders will only conduct soft credit checks on your report when you submit your initial loan request. As such, you don’t have to worry about your credit score being negatively impacted even before you have a chance to review what offers are available to you.

However, do keep in mind that if you fail to repay your loan on time, there is a high chance that your lender can decide to report this delinquency to the major credit bureaus. This will lead to your credit score being affected, which could make it difficult for you to secure further credit in the future.

Conclusion

USInstallmentLoans is a credit platform that is dedicated to helping borrowers access funding, no matter what their credit history may be. The online application is fairly simple and straightforward, with no excess paperwork or long wait times to deal with.

You can also apply for a wide variety of loan products, and since it is free to use, this makes it one of the most accessible lending platforms to rely on online. This makes it worth checking out for anyone in need of a fast installment loan from a trustworthy lender.

It’s definitely two thumbs up from us!