2022 Tax Refund Schedule Chart {Mar} A Precise Info!

Do you want to know when you can expect a tax refund? If you answered yes, you should know that it can take up to 21 days to receive a refund of tax.

Aside from that, your choice in filling out a tax form and a variety of other factors may have an impact on the time.

People in the United States of America are looking for information on the 2022 Tax Refund Schedule Chart.

The United States government recently announced tax refund dates.

What is Taxation?

The term taxation describes the entity. Taxes are generally required to be paid to our government by its citizens and residents. Since our civilization’s start, taxes paid to government officials and other departments have been integral.

Therefore, collecting various taxes from various sectors is referred to as taxation.

Taxpayers can file their tax returns by mail or electronically. Filing taxes electronically is the quickest way to file and process them. Receiving your refund electronically via direct deposit is also the quickest way to receive a refund.

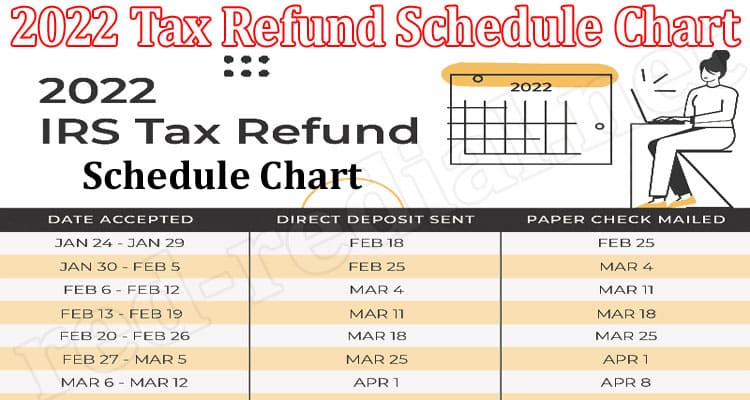

2022 Tax Refund Schedule Chart-Summary.

On January 24, 2022, the IRS began accepting 2021 tax returns. The IRS has not yet released its refund schedule for 2022, but you can use the chart below for estimating the tax refund via direct deposit or paper check.

| Tax accepted Dates | Sent Deposit Direct | Mailed paper check the date |

| January 24 to January 31 | February 7 | February 14 |

| February 6 to February 7 | February 14 | February 21 |

| February 15 to February 21 | February 28 | March 7 |

| February 22 to February 28 | March 7 | March 14 |

| March 1 to March 07 | March 14 | March 21 |

IRS Tax Refund Schedule 2022 Chart Delivery Time.

Furthermore, go through the IRS Tax Refund Delivery Times:

| Type of delivery | Time of Delivery (Receipt of tax refund with date) |

| The E-file (direct-deposit) | 1-21 days |

| Paper file (direct deposit) | 1-21 days |

| The E-file with a refund check (mail) | 42-56 days |

| The paper file with a refund check (mail) | 42-56 days |

How to Track Tax Refunds?

People are confused about their tax refund information. As a result, the IRS developed an app called IRS2GO. An app that allows you to track the progress of your return. You can check the status of your refund in an online portal.

Now, lets us conclude Tax Refund Schedule 2022 Chart below.

All the knowledge gathered is from the internet.

Final Thoughts

When you receive your tax return, it will also depend on filling out the form. Filling it electronically, is the best method for quick results.

Additionally, take note of this date and submit all necessary information to receive a tax refund.

The refund payment checking procedure takes two to three weeks. So, we suggest you submit it as soon as possible.

Do you intend to file a tax return? Also, refers to the official website

Comment your thoughts on the 2022 Tax Refund Schedule Chart in the comment section below.

Also Read : – Tax Refund Schedule 2022 Chart {Feb} Complete Insight!