Irs Refund Schedule 2022 Chart {Feb} Track Progress Help

This article describes the various dates and official processes associated with the latest American tax repayment. Read more on Irs Refund Schedule 2022 Chart.

Are you interested to know about the current year’s tax repayment by Internal Revenue Service? If yes, this article elaborates all the relevant information on this topic from the significant aspects of the repayment process and the online methods available to track the process.

Taxpaying citizens from the United States look for significant criteria and other important timestamps to know the approximate payment receival. Read this article till the end to learn more on the Irs Refund Schedule 2022 Chart.

About IRS Tax Refund

A tax refund is the repayment of the excess tax paid by the citizen to the state or federal government. Internal Revenue Service (IRS) is responsible for calculating and distributing the tax refunds.

The taxpayers who overpaid the tax tends to receive the tax payment. The other category of people eligible for the tax refund is those who qualify for the tax credit benefits such as PTC, CTC or EITC. The refund is processed after the verification from IRS officials, and the taxpayers receive it within a fixed time.

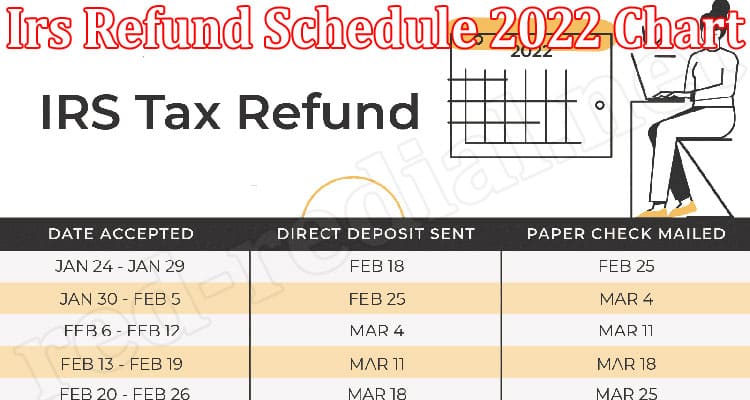

Irs Refund Schedule 2022 Chart

The tax accepted date and refund as direct deposit are mentioned below: [Note that the paper check date is 7 days after the direct deposit date].

- January 24 – January 31: February 7

- February 6 – February 7: February 14

- February 8 – February 14: February 21

- February 15 – February 21: February 28

- February 22- February 28: March 7

- March 1- March 7: March 14

- March 8 – March 14: March 21

- March 15 – March 21: March 28

- March 22 – March 28: April 4

Continuing Refund Schedule Chart 2022

- March 29 – April 4: April 11.Read more on Irs Refund Schedule 2022 Chart.

- April 12 – April 18: April 25

- April 5 – April 11: April 18.

- April 19 – April 25: May 2

- April 26 – May 2: May 9

- May 3 – May 9: May 15

- May 10 – May 16: May 23

- May 17 – May 23: May 30

- May 24 – May 30: June 6

- May 31 – June 6: June 13

- June 7 – June 13: June 20

- June 14 – June 20: June 27

- June 21 – June 27: July 4

- June 28- July 4: July 11

- July 5 – July 11: July 18

- July 12 – July 18: July 25

- July 19 – July 25: August 1.

- July 26 – August 1: August 8.Learn about Irs Refund Schedule 2022 Chart.

How to track refund progress?

- The IRS has introduced an application, IRS2Go, that helps taxpayers track their refund progress.

- An IRS online portal, “Where’s My Refund?” also helps the taxpayer track the tax status.

- As mentioned earlier, the citizen can track three significant steps for the refund process.

Conclusion

The tax refund is one of the essential processes for a taxpaying citizen, and the federal tax refund procedures and the taxpayers highly anticipate repayment time. To know more on this topic, please visit.

Have you checked the official website details about the Irs Refund Schedule 2022 Chart? If yes, please comment on your valuable findings below.

Also Read : – 2022 Tax Refund Schedule Chart {Feb} A Precise Info!