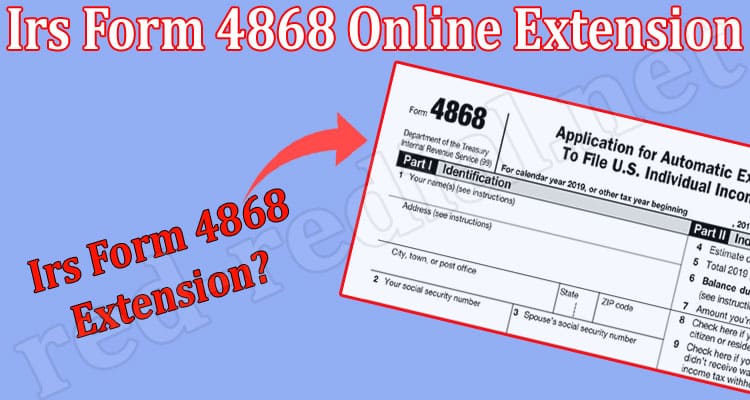

Irs Form 4868 Online Extension {April} Explore Criteria!

This article is about Irs Form 4868 Online Extension and regarding its process of filing. Read more.

Are you a taxpayer? Do you know about Form 4868? If you want to know more about this, read the article till the end.

People from the United States can use an automatic extension of time to file an individual income tax return as its last date was 18 April 2022.

By filing Irs Form 4868 Online Extension, an individual can pay all or part of your income tax due. Filing of Form 4868 indicates that you have an extension of the payment of income tax.

What is Form 4868 online extension?

An automatic extension of filing a U.S income tax return can be requested by applying three ways. These are the following.

- Making the payment of all or part of an income tax due indicates that the payment is for an extension by using Direct pay, Federal Tax Payment System, or by using Credit or Debit Card.

- By filing Form 4868 Online Free accessing IRS e-file by using a tax software by electronic means. You can also take the help of a professional who uses e-file.

- A paper Form 4868 can also be filed by enclosing payment of estimated income tax due.

Those citizens who live in the U.S. get an extension of two months to file their income tax returns, and they can pay the amount without requesting an extension. If you are outside of the country and a resident of the U.S., you can pay your tax by June 15, 2022.

However, you must fulfil some bona fide residence or physical presence test to get this extension.

When to file Irs Form 4868 Online Extension?

If you are a citizen of the U.S., you can file Form 4868. By filling out this form, you can get an extension of two months to file your income tax return when you are outside of the country. You don’t need to request an extension when you file this form. But, you have to go through some residence tests by the due date of your return.

Under the following circumstances, you will be deemed to be out of the country:

- When you live outside of the US and Puerto Rico and your workplace is also outside of the US and Puerto Rico, you can file Irs Extension Form 4868 Online

- You are doing a job in military or naval services outside of the US and Puerto Rico.

Although you are present in the US or Puerto Rico, you will be eligible for the extension when you qualify for being in the US or Puerto Rico.

Generally, the extension cannot be granted for more than six months. However, you are eligible for an extension if you live outside of the country.

Conclusion

The purpose of form 4868 is to give an extended opportunity to file the income tax return to those who live outside of the US and Puerto Rico. Irs Form 4868 Online Extension can be filed in paper and mail it to the proper address.

Did you find the article useful? If so, give the feedback below.

To know more details, please visit this page.

Also Read : – What Is Watch The Water About {April} Platform Details!