Can UKBadCreditLoans Be Trusted? – A Comprehensive Review of the Lending Service

UKBadCreditLoans is an online credit service that allows borrowers to access loans of up to £5,000 with APR rates that vary up to a maximum of 49.7% and repayment periods that range between 1-36 months.

Bear in mind that UKBadCreditLoans is not an actual lender but provides the platform that borrowers need to instantly find potential lenders, even if they have bad credit.

You can also take out UK loans with bad credit from UKBadCreditLoans entirely online, which means that you don’t have to deal with excessive paperwork or long lines at a physical branch.

And since all loans processed via their site are processed within 24 hours, this makes UKBadCreditLoans ideal for dealing with unexpected financial emergencies.

What To Know About UKBadCreditLoans Before Applying For A Loan?

There are several types of loans that you can apply for via UKBadCreditLoans, which makes it extremely easy to secure funding that is specific to your budget and requirements.

According to UKBadCreditLoans co-founder Emilia Flores, “With dozens of online lenders in our network, we aim to provide borrowers with an extensive range of credit options to help them deal with a wide variety of financial challenges.”

In this regard, some of the main loans you can apply for include payday loans, same-day loans, quick loans, short-term loans, and more.

- High-interest rates: One thing you should always keep in mind is that the APRs offered by UKBadCreditLoans’ partner lenders will often be higher than what you would normally get from a traditional lender like a bank or credit union. However, this is often influenced by your credit score, as the lower it is, the more likely you will be charged a higher APR because of the higher risk of default.

- Varying loan terms: There is a chance that UKBadCreditLoans’ partner lenders will charge a fee for any cash borrowed. For instance, some lenders will typically charge an origination fee, while others may even charge a pre-payment penalty for repaying the loan too early. As such, it is always important that you take the time to review the loan terms offered before you sign any agreement.

- Bad Credit Accepted: As mentioned before, UKBadCreditLoans’ lenders are open to accepting borrowers with a less-than-stellar credit rating. This makes it an ideal place to turn to if you need to if you have been unable to secure approval from a bank or credit union. This is because most of their lenders will usually look at other factors besides just your credit score such as your income level, employment status, etc.

How Does UKBadCreditLoans Work?

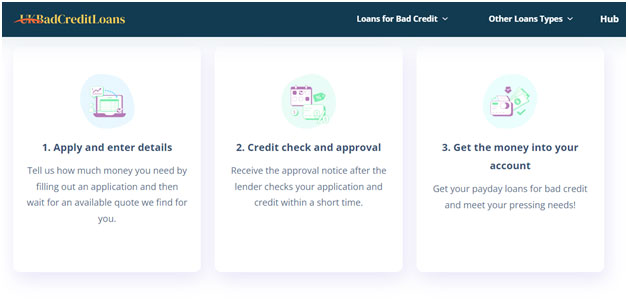

UKBadCreditLoans offers borrowers one of the easiest platforms to apply for a loan online, as it only takes a few minutes to find a lender that is willing to provide you with appropriate loan rates and terms. In this respect, you need to follow the steps below to secure a loan via their lending network.

Step 1: Get A Loan Offer

The first thing that you need to do is head over to UKBadCreditLoans.com. From there, you simply fill out the online form with your personal and financial details, which should only take a few minutes. The good news is that their lenders will not conduct a hard credit check on your loan request, so you can feel free to submit it without fear of your credit score being lowered.

Step 2: Review Your Options

Once you submit the form, it will be reviewed, and if approved, you can expect to be presented with multiple pre-approval offers from several different online lenders. Bear in mind that these are only pre-approvals, so there is no official guarantee that you will receive the loan.

However, you will be able to view and compare your actual pre-qualified rates. It is at this point that you will need to take your time to review the loan offers available to you, in order to ensure that you are choosing the right loan with the terms and conditions that are best suited to your situation.

Step 3: Apply For Your Personal Loan

Once you pick a lender, you simply need to accept the loan offer by e-signing the agreement, and from there, the lender will start to process your funds. This should normally take no more than one business day before the funds reflect in your checking account. However, this can vary depending on the date of the application and the processing times at your bank.

What Are The Pros of Using UKBadCreditLoans?

- The service is completely free-to-use

- Offers a safe and secure lending platform

- Provides access to dozens of online lenders

- Positive online reputation

- Fast loan processing

- Only requires a soft credit inquiry to initiate a loan

What Are The Cons of Using UKBadCreditLoans?

- Limited loan amount (£100-£5,000)

- Does not directly offer loans

FAQ

What Is UKBadCreditLoans’ Criteria?

Before you are able to successfully apply for funding via UKBadCreditLoans’ partner lenders, it is important that you first satisfy all the necessary eligibility criteria needed to request a loan. These include;

- Being at least 18 years old

- Being a UK citizen or permanent resident

- Having a steady source of income

- Having an active bank account in your name

Does UKBadCreditLoans check credit?

UKBadCreditLoans does not provide loans directly, which means that they are not the ones who carry out any credit checks on your loan request. It is their partner lenders who will check your credit report, but the good news is that they will only conduct soft credit checks. This means that you don’t have to worry about your credit score being lowered just by submitting your loan application form.

Who Is UKBadCreditLoans Best Suited For?

UKBadCreditLoans is the ideal lending solution for anyone that finds themselves cash-strapped and with little time to apply for a traditional loan. And even if you are able to wait, there is a high chance that you may not be able to secure approval because of a bad credit score. In such cases, using an online service like this one can help you access the funding you need with minimal difficulty.

What Can You Use UKBadCreditLoans For?

There are multiple reasons why you would need to borrow a loan from UKBadCreditLoans’ lending network. And since their partner lenders do not impose any restrictions on how you can use the funds you receive from them, you can feel free to use the money as you see fit.

In this respect, some of the most common reasons people take out loans from such lending services include; debt consolidation, medical expenses, utility bills, home renovations, travel expenses, etc.

Final Verdict: Can They Be Trusted?

After reading our review, you’ll see that UKBadCreditLoans is a great choice for anyone who finds themselves cash-strapped and in need of quick funding. You also don’t have to worry about being able to secure approval, even if your credit score is poor.

The service also doesn’t charge borrowers anything, so you can use the platform to see what potential offers you can get without any fear of having to make a financial commitment. Plus, UKBadCreditLoans only partners with FCA-compliant lenders, so you can rest assured that you will not fall victim to any predatory or unscrupulous lending practices.

All in all, it’s safe to say that you have nothing to lose by trying out the service today, but do remember that most of the loans offered will come with higher-than-average interest rates. As such, you should always be confident that you can afford to make your repayments before formally signing any loan agreement.